Right on the Money

John Edward Dallas offers advice about government student loans.

By John Edward Dallas

Question: Can you tell me what it means to have government student loans in default and what solutions are available? Thank you.

—Submitted by T.R.

Answer: When a government student loan—or any other type of loan— is in default, it means that the borrower stopped making payments according to the contract he/she signed with the lender. A government student loan is generally in default when the borrower fails to make nine monthly payments in a row.

There are many serious consequences of a defaulted government student loan. Here are a few of them:

- The borrower becomes ineligible for federal financial aid.

- The entire balance of the loan becomes due immediately.

- The default appears on the borrower’s credit report, potentially affecting the borrower’s ability to obtain certain types of employment, housing, and credit.

- Large collection fees are added to the loan balance because it’s taken over by a government-assigned collection agency.

- The borrower’s tax refund may be seized and a portion of wages may be taken to repay it.

There are two key ways to avoid defaulting. First, keep track of when your payments are due and always make them on time. Second, as soon as you’re having trouble affording your payments, contact your loan servicer and apply for a government-approved payment plan, which by law must be adjusted to a borrower’s income (or lack of income) – it’s not uncommon for a payment plan to be zero dollars a month!

How do you get a government student loan out of default? The most common solution in my professional experience is rehabilitation: The borrower agrees to make nine out of ten monthly payments on time to the collection agency. At that point the loan is no longer in default and is no longer handled by the collection agency. With a fresh start, the borrower continues making monthly payments and has one less financial matter to lose sleep over.

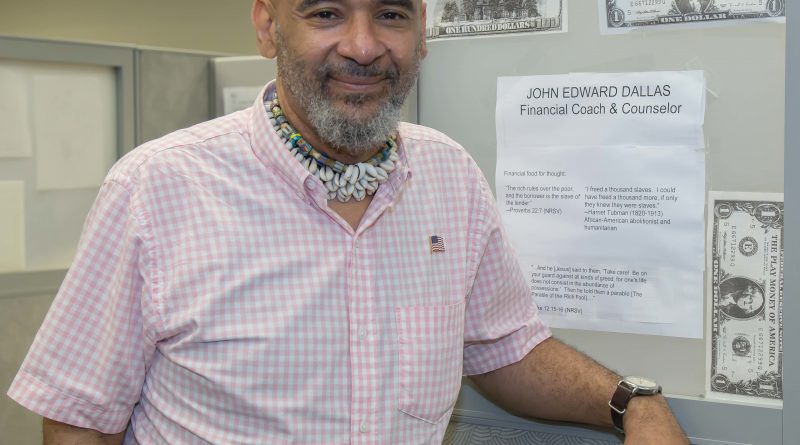

John Edward Dallas is a coordinator of financial services at the Bedford-Stuyvesant Restoration Corporation’s Jobs-Plus site in Brooklyn. Jobs-Plus is a national program with nine sites in New York City that help public housing residents become economically empowered. Mr. Dallas grew up in Baruch Houses and is proud to serve the NYCHA community.

Residents, if you would like to request an appointment for a free, one-on-one session with a certified financial counselor, visit “Opportunity Connect” on NYCHA’s Self-Service Portal (https://selfserve.nycha.info).