NYCHA Residents Build and Improve Credit Scores with Working Credit

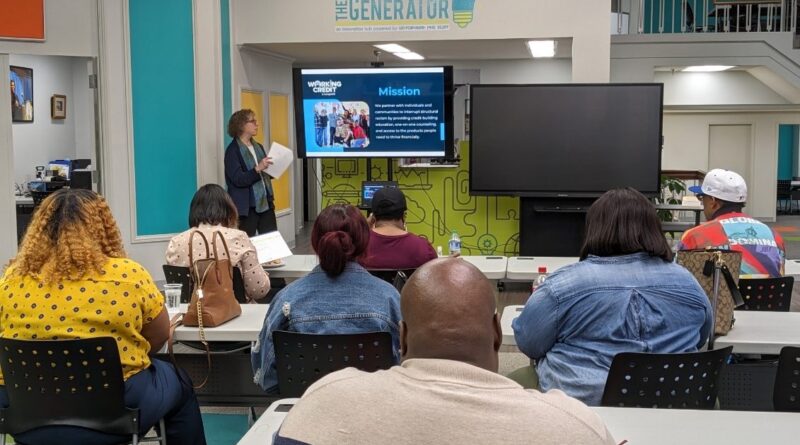

Since June 2022, NYCHA’s Resident Economic Empowerment and Sustainability (REES) Office has partnered with Working Credit to help NYCHA residents in public housing and Section 8 take the steps they need to improve their credit scores. Working Credit is a non-profit organization that provides credit-building workshops and counseling to help participants achieve their financial goals.

The NYCHA Journal spoke with Morgan Spears, Chief Community Engagement Officer at Working Credit, to learn more about the organization, its mission to interrupt structural racism in the credit system, and how it partners with NYCHA residents.

Tell us about Working Credit.

We’re a national non-profit with a mission to interrupt structural racism by providing equitable access to credit-building education, credit-building counseling and coaching support, as well as getting people connected to affordable products they need to thrive financially. We serve a lot of different organizations and companies all across the country.

We offer workshops where we do an in-depth dive about what credit is and how the credit system works. Our goal is to demystify credit because there’s so much misinformation out there that can lead people astray. We want to get people accurate information about the credit system so they can build or rebuild their credit in a way where they’re able to thrive [according to how] financial success looks like for them. We recognize that how one person defines financial success is different than the next person.

We provide one-on-one credit-building counseling and coaching support. This is how we partner with NYCHA residents. An individual gets paired with a credit-building counselor and they’ll work together for an entire year, so that person could message the counselor as much or as little as they want. They do a 60-minute credit building counseling session where they discuss what their financial goals are, what their current financial status is, and where they want to be in three months, six months, or 12 months from now. In the counseling session we pull their credit report; it’s a soft pull that does not impact the credit score because we’re doing it for educational purposes. We’re able to show them what’s on their report, what their credit score is today, and how we can help them improve or increase their credit score to reach their goals. We then create a credit action plan that’s very individualized and tailored to that person.

What does successful completion of the program look like?

One thing I love about our program is that the way we define success is based upon that individual’s credit action plan. That being said, we do have some primary metric indicators, such as how many residents increase their credit score from when they started the program until when they hit the 12-month mark, but most importantly, how many of those residents were able to get a prime credit score, which is above a 660. Ideally, we’ll have a lot of people increase their credit score – but a score above a 660 will make a substantial financial difference in how they’re able to navigate their day-to-day finances.

Can you share a success story with us?

Yes! We had a NYCHA resident who started with a pretty low credit score of 490, as well as unpaid collections that were affecting her credit rating. Despite facing a tough time with her income decreasing, she kept working hard on her credit. We helped her get rid of that unpaid collection, and in just one year her credit score increased 172 points.

We’ve reached over 300 NYCHA residents. In our data from 2023 with NYCHA residents after 12 months, 42 percent of total residents reached a prime credit score, and 60 percent of the total increased their overall credit score. There were people who started the program without a credit score, but after completing the 12 months in the program, 100 percent of the residents we work with became scorable.

We try to reach as many residents as we can. Next month we’re going to be doing more workshops and starting our next cycle with NYCHA residents.

Is there anything else you want NYCHA residents to know about Working Credit?

I want to highlight that Working Credit is very committed to interrupting structural racism and we recognize that a large part of our financial system historically and currently is rooted in systemic racism in terms of how it was created and how it oftentimes keeps a large majority of people of color outside of being able to access affordable credit. Even though the credit-scoring algorithm itself does not take race into account, our financial system does.

I’m a big proponent of making sure people have the proper knowledge, but having knowledge is one thing; having the opportunity and support to implement what you know is another thing. What our program really tries to get at is to create more equity in the credit system to allow for people who have historically been disenfranchised and marginalized out of financial systems to be able to enter the space, not just with knowledge but also with the support that’s needed for them to thrive.

NYCHA residents looking for assistance with building or improving credit and managing debt can call the REES Hotline at 718-289-8100 to be connected to partner services. NYCHA residents and Section 8 participants can register for an upcoming Working Credit Credit-Building Workshop on May 14 by visiting Working Credit- Credit Building Workshop | OpportunityNYCHA – REES.